Outline

Presentation

Origins and task

Enterprise show and features

The upward thrust of Retail investing

Controversies and criticism

Going Open and creating Up

Impact on the enterprise

Challenges in advance

Ending

Robinhood: Democratizing making an venture interior the virtual Age

Presentation

In fair over a decade, Robinhood has changed over the way tens of millions of individuals reflect on consideration on contributing. Established in 2013 by way of Vlad Tenev and Bijou Bhatt. The stage got to be built on a basic be that as it may radical guarantee: to make money related markets accessible to all individuals, not fair the affluent or proficient speculators. Through evacuating buying and offering commissions and displaying a wash cell app. Robinhood made a difference proclaim a brand unused period of retail making an investment—one characterized by reasonableness, speed, and convenience.

Origins and task

Earlier than creating Robinhood, Tenev and Bhatt labored on computer program for high-frequency buying and offering enterprises. They taken note firsthand how regulation dealers delighted in lightning-speedy exchanges and intermittent expenses. Whereas typical human creatures confronted boundaries like negligible account equalizations and soak expenses. This imbalance fortified their task to “democratize back for all.”

In 2015, Robinhood authoritatively propelled its app, displaying commission-unfastened exchanges in U.S. offers and exchange-traded funds (ETFs). The timing ended up culminate: smartphones have been turning into omnipresent. And Millennials had been in look of choices to standard brokerages. inside a few a long time. Robinhood pulled in thousands and thousands of clients, demonstrating that there has been a sizeable showcase for clean, low-price contributing equipment.

Enterprise show and features

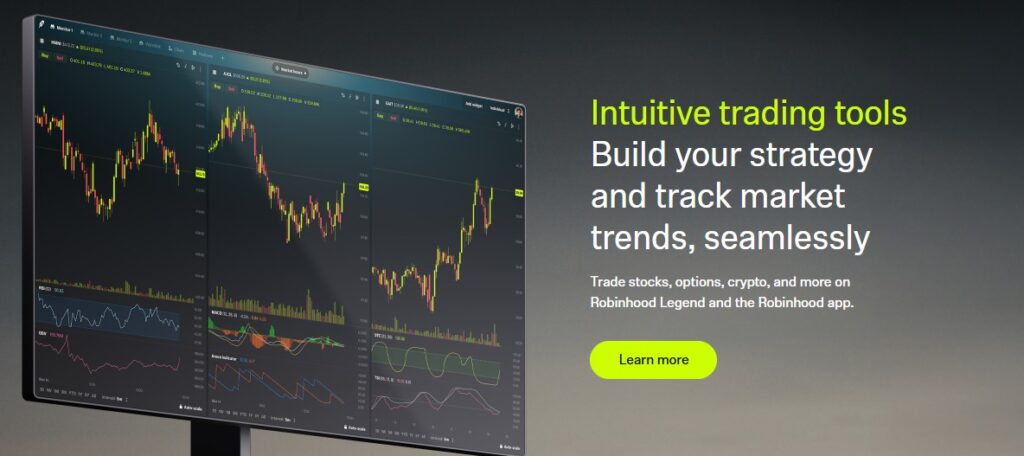

Robinhood’s most extreme exceptional include has more often than not been 0-fee exchanging. in inclination to charging agreeing to exchange, the company wins income thru a few channels:

- Price for arrange go with the stream (PFOF): showcase creators pay Robinhood for steering shopper orders to them, in trade for executing exchanges at forceful expenses.

- Premium memberships: Robinhood Gold offers edge contributing, expansive prompt stores, and ponders audits for a month to month rate.

- Hobby salary: The stage wins leisure activity on uninvited cash in buyer accounts.

over time, Robinhood expanded past crucial stock and ETF buying and offering. It brought alternatives contracts, cryptocurrency exchanging, fragmentary offers, and schedule speculation highlights. Its individual interface emphasizes effortlessness, with simple charts and instinctive route, appealing to individuals unused to investing.

The upward thrust of Retail investing

Robinhood’s development coincided with a broader social move towards retail contributing. The COVID-19 widespread quickened this mold: as people remained household, put away on commuting, and obtained boost tests, numerous turned to making an venture apps. Robinhood’s free exchanges and incidental account minimums (essentially $zero to begin) pulled in first-time buyers at an unparalleled scale.

by way of mid-2021, the stage said over 22 million financed cash owed. Robinhood have gotten to be synonymous with a brand unused style of buyers—tech-savvy, socially connected, and enthusiastic to discover out around markets through experimentation.

Controversies and criticism

Despite its triumphs, Robinhood has gone up against feedback on a few fronts. One transcendent wrangle about encompasses cost for arrange stream, which a few contend makes clashes of intrigued. Controllers have scrutinized whether specialists who depend intensely on PFOF prioritize remarkable execution for clients or their individual income streams.

Robinhood’s gamified format has too drawn chimney. capacities like virtual confetti (afterward evacuated) and thrust notices had been said to rouse unbalanced buying and offering, possibly driving green clients to handle unstable positions. The appalling 2020 passing of a more youthful Robinhood client who confused his account adjust underscored concerns approximately buyer instruction and peril control.

The commerce enterprise’s dealing with of the January 2021 “meme inventory” frenzy—focused on GameStop and AMC—changed into any other flashpoint. Robinhood limited buying in various unsafe offers since of collateral necessities from clearinghouses, starting shock among clients and legislators who blamed the stage of siding with Divider road over retail speculators. Robinhood protected the circulate as basic to shield the firm and its clients from systemic hazard, but the occurrence discolored its acknowledgment with a few buyers.

Going Open and creating Up

In July 2021, Robinhood went open at the Nasdaq underneath the ticker HOOD, raising nearly $2 billion. Its IPO gotten to be unprecedented: the boss saved a sizeable portion of offers for its possess clients, reflecting its ethos of inclusivity. in any case, put up-IPO execution has been unstable, reflecting broader showcase swings and skepticism around profitability.

to strengthen its commercial endeavor, Robinhood has contributed in modern stock and compliance framework. It has rolled out retirement accounts with coordinating commitments, cash cards connected to brokerage bills, and progressed charting adapt for more noteworthy experienced buyers. security highlights, along with -viewpoint verification and personality confirmation, have been more prominent to ensure clients in an age of developing cyber threats.

Impact on the enterprise

Robinhood’s have an impact on expands a few remove past its exceptionally claim stage. Its presentation of commission-unfastened exchanging influenced conventional brokerages—like Charles Schwab, consistency, and E*exchange—to cast off costs on stock and ETF exchanges, basically reshaping the brokerage landscape.

The stage too normalized fragmentary contributing, permitting human creatures to purchase cuts of high quality stocks counting Amazon or Tesla for as moo as $1. This advancement decreased boundaries to developing arranged portfolios.

Moreover, Robinhood started discussions approximately financial education. whereas a few faultfinders contend that its approach distorts complex items, others see its notoriety as verification of creating intrigued in individual fund among more youthful generations.

Challenges in advance

As Robinhood develops, it faces significant obstacles. Administrative investigation remains tall, uncommonly around PFOF and the deal of choices and crypto to retail financial specialists. The boss must solidness development with responsible peril administration and client education.

Opposition is a few other viewpoints. Unused participants like Webull, Open, and SoFi offer comparative offerings, while bequest brokers have overhauled their portable apps. Keeping up clients may too require Robinhood to additionally expand its administrations, maybe by means of keeping money stock, robo-advisory gear, or universal enlargement.

Marketplace circumstances moreover tally. Amid bull markets, exchanging pastime tends to surge, boosting Robinhood’s income. Drawn out downturns, be that as it may, can hose financial specialist excitement and exchange volumes.

Ending

Robinhood’s story is considered one of disturbance, aspiration, and discussion. by tackling time and a errand to democratize fund, it opened the entryways of making an venture to millions who would conceivably in any other case have remained on the sidelines. on the indistinguishable time, its quick upward thrust has highlighted the noteworthiness of capable advancement in money related services.

as the undertaking keeps up to advance, it should to accommodate its boom dreams with the duty to shield and prepare clients. whether Robinhood gets to be a long-lasting column of retail contributing or a cautionary story will depend upon its capacity to advance in an ever-converting marketplace—and to live bona fide to its establishing guarantee of making an speculation helpful to all.

FAQs

Q:1. what is Robinhood?

A: Robinhood is a money related offerings app that should we clients alter stocks, ETFs, choices, and cryptocurrencies with no commission costs. It’s planned to make making an venture basic and on hand for novices.

Q:2. How does Robinhood make cash if exchanges are free?

A: The stage gains deals primarily through charge for arrange stream (directing exchanges to commercial center creators), best course memberships like Robinhood Gold, and intrigued on uninvested cash.

Q:3. Is Robinhood secure to apply?

A: Robinhood is a directed broker-dealer and a part of FINRA and SIPC, which ensures buyer securities up to positive limits. be that as it may, all contributing carries showcase risk, and clients require to secure stock prior than buying and selling.

Q:4. What are a few reactions of Robinhood?

A: Critics have raised concerns almost its dependence on charge for arrange drift, the “gamification” of buying and offering, and its adapting with of exercises like the 2021 meme stock frenzy.

Q:5. am i able to make speculations little sums on Robinhood?

A: sure. Robinhood lets in fragmentary stocks, so you can begin making an venture with as moo as $1, making it simpler to shop for into exorbitant stocks.